The Business of Soccer Upended by the Coronavirus: Advice For Soccer Coaches and Soccer Clubs

Info on CARES Act and Employment Contracts

The world of youth soccer is a complex myriad of often conflicting objectives. The perils of Coronavirus COVID-19 are impacting the youth soccer landscape, and without a clear end in sight, the extent of the economic damage is still unknown.

Now, during this forced hiatus of soccer due to the Coronavirus COVID-19, many coaches are discovering their paychecks cut, or worse, non-existent. Youth soccer clubs are in the untenable position of having to furlough soccer coaches to close a budget gap caused by the pandemic and stay at home orders that have lasted for weeks.

The question is, how can coaches and their youth soccer clubs work together to best weather the pandemic’s storm?

And, when life returns to a better new normal, what can soccer coaches do when negotiating new contracts?

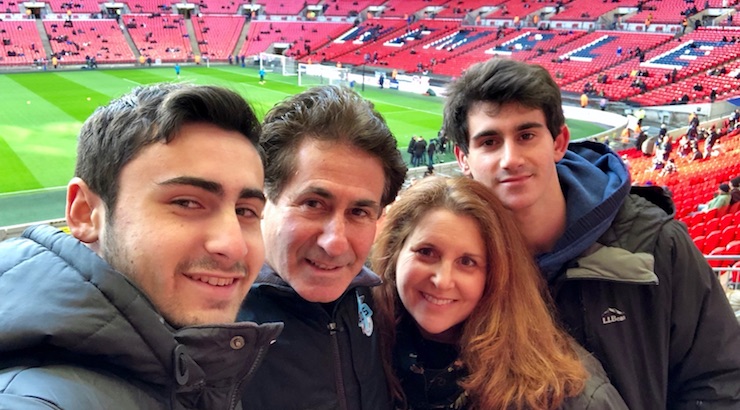

Former U.S. Soccer presidential candidate Steve Gans is a highly respected Boston based attorney who specializes in the areas of corporate, sports, and employment law. Involved in American soccer since the 70s, Gans understands the dilemmas faced by many soccer coaches and youth soccer clubs. It can often be a delicate balancing act between the financial sustainability of the soccer club and the perceived and real value of a coach.

Read: FAIRNESS AND REFORM – STEVE GANS SPEAKS OUT

A soccer dad as well, Gans is a highly sought after expert on Employment Contracts in our soccer world and advises many sports organizations. We knew he would have great insights to share.

SoccerToday Interview with Steve Gans

Diane Scavuzzo: What advice can you share with coaches who discover they have no paycheck during the Coronavirus COVID-19 pandemic?

Steve Gans: The first thing I would say is clarify your status with your youth soccer club so you can understand the lay of the land and the benefits for which you may be qualified.

If you are laid off or furloughed (a concept whereby the employer temporarily stops paying salary but covers benefits during the period), you are likely eligible for unemployment insurance benefits.

Each state runs its own unemployment insurance program, so the level of benefits will vary from state to state; however, as part of the COVID-19 federal relief package, every eligible employee receives a $600 weekly supplement on top of the unemployment insurance amount determined by the state at issue.

Diane Scavuzzo: What advice can you share with clubs today in the midst of this pandemic?

Steve Gans: I have been advising several clubs during this crisis, on issues including COVID-19 employment-related issues, tenant (rent) issues, other expense-side issues, business interruption SBA Economic Injury Disaster Loan (“EIDL”) program and CARES Act Paycheck Protection Program (“PPP”) loan program issues, workplace privacy and disclosure issues, and coach recruitment/defection matters, so a lot has emerged as a result of the pandemic.

Youth soccer clubs suddenly without revenue are facing pressure – bills keep coming in, but revenue has stopped.

On the expense side, I encourage clubs to engage in sincere proactive dialogue with their counterparts on the contracting side, whether they be landlords of facilities the club rents, schools or municipalities from which the club rents fields, leagues or tournament organizers. This really is an unprecedented time, and in many cases, landlords have forgiven or deferred rent for a month or more.

Likewise, depending upon the terms of the contract at issue, the club could be entitled to at least partial payment forgiveness and/or refunds (or credits as the case may be) relating to field rentals, and league and tournament fees.

On the revenue side (and also expense side) clubs should investigate their eligibility for an EIDL loan and PPP loan (this is discussed more in the question below). From the practical and business side, the club should make sure to provide its player members with coaching and training advice and programs in a virtual setting.

Engagement with players and their families and the provision of useful coaching and training activities is a must.

Diane Scavuzzo: Any thoughts you can share on The Small Business Owner’s Guide to the CARES Act?

Steve Gans: Here is a brief summary: Under the PPP loan program an eligible organization can have up to 8 weeks of employee payroll costs covered, and the loan proceeds may also be used to cover mortgage interest payments, rent, and utilities.

75% of the PPP loan proceeds must be used for payroll-related costs, and up to 25% may be used for those other listed operating expenses. If an organization meets that 75%-25% ratio and meets certain thresholds relating to employing/re-hiring and having in-place an appropriate number of full-time equivalent employees, it may be eligible for loan forgiveness (so-called “free money”).

If the organization does not meet those standards, the loan will convert to a 1% loan. Organizations securing both EIDL loans and PPP loans should be aware that in such cases the proceeds of the EIDL loans may not be used for payroll costs.

Some other important things to keep in mind: all recipients of a PPP loan must sign a good faith Certification regarding (amongst other things) use of the proceeds and other possible sources of capital, and the government has announced an intention to audit at least all PPP loans of $2,000,000 or more.

Here are a few reference alerts we shared with our clients:

Diane Scavuzzo: From a business perspective, what should DOCs do to keep their clubs strong and vital during this outbreak so when soccer starts up again, they are ready?

Steve Gans: As noted above, DOC’s must ensure that the club and its coaches stay engaged with players and their families and that they provide useful coaching and training activities and drills virtually. Continued provision of value is a must. Aside from fitness and technical skills sent out virtually, clubs should engage through club member bonding activities, such as video game (FIFA) tournaments in which club players can participate.

Every single service that the club can provide remotely should be offered.

For instance, especially now (given the current uncertainty in college soccer), college recruiting advice and advocacy for club members should be emphasized, and real value should be provided in that area.

The DOC should be in consistent contact with the coaches who may have been furloughed, in order to keep continuity and to update them about possible return dates. Since U.S. Soccer discontinued the Development Academy nearly every club (whether DA or not) is scrambling to get its teams into the best and most appropriate leagues.

The DOC must devote a lot of time to that process, as well as negotiate with landlords, vendors, and other contracting partners for relief, as noted in more depth above.

Diane Scavuzzo: All too often coaches find themselves feeling unprotected by their employment agreements with youth soccer clubs. Why is this?

Steve Gans: I am often asked to draft model Coaching Agreements for clubs, as well as bespoke Employment Agreements that the club wants to have in place with the DOC. In fact I just this week completed model Coaching Agreements (two versions) for a leading club. It seems to me that there are basically three different types of coaching agreements in youth soccer.

- The first is a standard agreement for coaches that coach a team or teams for the club, but who don’t have management or leadership roles within the organization. Those are usually relatively short agreements (2-3 pages plus Exhibits), and the employment relationship is usually at-will in nature.

- The second is for coaches at the director and leader level for the club, with management responsibility.

- These agreements are also relatively brief (3-4 pages plus Exhibits), and the employment relationship may be at-will or it could have specific termination provisions (elevating it from at-will status).

- The third is for the DOC. These agreements are full on Employment Agreements, containing customary and bespoke provisions (they may be 6-10 pages plus Exhibits).

I think many coaches may feel relatively unprotected because they receive the first version at-will agreements in connection with employment with the club.

Diane Scavuzzo: In your opinion, are most coaches are independent contractors? Or employees?

Steve Gans: In almost all cases, I urge clubs to classify their coaches as employees. There is a 20 part IRS test for determining whether one is an independent contractor, and thus, a club can’t just classify a coach as an employee or an independent contractor for convenience.

The IRS and various state departments of revenue have audited, sanctioned and fined youth soccer clubs for misclassifying coaches as independent contractors.

I’ll never forget giving this best practice tip while speaking at a conference about 5 years ago, and a member of the audience raised his hand and said,

“C’mon. What are the odds that a state department of revenue would go after a little soccer club?”

Whereupon an Executive Director of a club from Colorado immediately stood up and said,

“My club was audited, and we have already spent over $80,000 on lawyer fees trying to fix the problem and resolve the case.”

Diane Scavuzzo: When it comes to a coach negotiating an employment contract, what advice can you share?

Steve Gans: The coach should do his/her homework in terms of researching what coaches at other clubs in the territory with similar responsibilities are being paid, so that he/she can be sure that the club is offering at least market salary.

If it is not, the coach should use that information to negotiate a higher salary.

The coach should inquire about what if any employee benefit programs the club may have and not be bashful about understanding his/her eligibility therefor. In terms of career development, the coach might ask whether the club will reimburse for coaching license course-related expenses.

And, if the coach has leverage, he/she should try to secure an agreement which provides more security than an at-will agreement.

Diane Scavuzzo: How would you recommend a youth soccer club handle the contract negotiation?

Steve Gans: I will focus here on the most important employment agreement for the club – the Employment Agreement of the DOC.

I went through the anatomy of a DOC contract at the Kwik Goal Club Summit in Orlando this past February, and I will touch on several of the best practices drafting tips and takeaways I provided there, as follows:

- The Term of the Agreement should be a reasonable one. Given how much can and often does go wrong in relationships within this crazy enterprise of American youth soccer, I recommend (depending on the circumstances), a contract length of 1-3 years, but no more than 3 years.

- It is essential that the Agreement spells out clearly the duties and responsibilities as well as the time commitment expected of the DOC.

- If the club is a non-profit organization, the DOC can only be paid “reasonable compensation” (pursuant to IRS rules), which puts specific research and other responsibilities upon the Board in establishing the DOC’s Salary.

- A Compensation Committee of the Board should set the DOC’s Salary, and if the DOC is on the Board, he/she should recuse themselves from any matters pertaining to his/her remuneration.

- Ideally, any Bonus paid to the DOC should be at the sole discretion of the Board. However, many DOC’s have the leverage or persuasive ability to get a bonus formula into their contracts. If the club is a non-profit, then such a bonus formula needs to be reviewed by a professional to confirm that it is in compliance with non-profit laws. Irrespective of whether the club is a for-profit or a non-profit entity, to the extent that the bonus is formula-based, there should be a provision in the Agreement allowing the Board to adjust such formula in the case of extraordinary transactions (such as a merger with another club).

- The Agreement should have a separate provision making clear that the DOC Reports to the Board.

- The Agreement should have robust For Cause Termination provisions. For cause provisions commonly in employment contracts should be included, but also in particular “Cause” should include such things as conduct that harms the club’s reputation, as well as inappropriate social media postings (acknowledging though and excepting an employee’s right to make comments about work conditions consistent with National Labor Relations Board law).

- The Agreement should also ideally include a Without Cause Termination provision whereby the DOC receives reasonable and adequate severance to address a situation wherein the relationship has grown stale and the club has to move in another direction.

- A Non-Competition clause may be included, but such provisions may or may not be enforceable, depending upon the jurisdiction and/or facts and circumstances.

- The Agreement should indeed have a Non-Solicitation provision, preventing the DOC from recruiting club coaches, employees, players, and corporate sponsors for a certain period of time after departing from the club (all such provisions are subject to reasonableness tests).

- A Confidentiality clause should be included in the Agreement, preventing the DOC from disclosing or taking such things as customer lists and club trade secrets.

- A provision stating that the DOC consents to the club’s right to seek Injunctive Relief in the event that the DOC breaches certain provisions of the Agreement should also be included.